Owning a home in Palos Verdes is one of life’s great privileges—but with that comes the responsibility of paying your Los Angeles County property taxes on time. To help make the process simple, here’s a complete guide with important dates, links, and resources every homeowner should bookmark.

🔍 Key Online Resources

-

Look Up Property Tax Bills: Click Here

-

APN Locator by Address: Click Here

-

Supplemental Tax Bill Estimator: Click Here

-

Homeowner’s Guide to Reducing Property Taxes: Click Here

-

Unsecured Tax Bill Questions: Call 213-893-7935 or email [email protected]

If you’re new to the area or recently purchased your home, these links will help you understand your parcel number, estimated supplemental bill, and any opportunities to lower your assessed value.

📅 Important Property Tax Deadlines

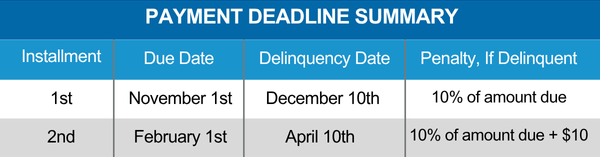

Property taxes are paid in two installments each year. Missing a deadline can result in penalties, so be sure to mark your calendar.

First Installment

-

Due Date: November 1

-

Delinquent After: December 10 (by 5:00 PM or postmark)

-

Penalty: 10% of the unpaid amount

Second Installment

-

Due Date: February 1

-

Delinquent After: April 10 (by 5:00 PM or postmark)

-

Penalty: 10% of the unpaid amount + $10 cost fee

💡 If December 10 or April 10 falls on a Saturday, Sunday, or legal holiday, the delinquency date extends to the next business day.

📆 What Each Installment Covers

-

1st Installment: July 1 – December 31

-

2nd Installment: January 1 – June 30

Together, these payments cover the fiscal year’s full property tax cycle.

🏠 Attention New Property Owners

If you recently purchased a home in Palos Verdes:

-

Annual tax bills are mailed in October and become available online in early October.

-

If you do not receive your bill, you’re still responsible for timely payment—visit the Los Angeles County Treasurer & Tax Collector website to download your bill.

⚠️ The County Assessor may take up to one year to update your records after a property transfers ownership, so keep an eye on your mail and the online portal for updates.

💻 Paying Online & Managing Your Account

You can manage your property tax payments and access your history using the Property Tax Management System.

View the Property Tax Management System User Guide for step-by-step instructions on creating an account, setting reminders, and submitting secure payments online.

🧾 Final Tip from a Local Expert

As a longtime Rolling Hills and Palos Verdes Realtor, I always remind my clients: staying current on your property taxes not only avoids costly penalties—it also keeps your title records clear and your investment secure. Whether you’re buying, selling, or just staying informed, being proactive with your tax payments is part of being a responsible homeowner. This is not tax advise and please verify all information.